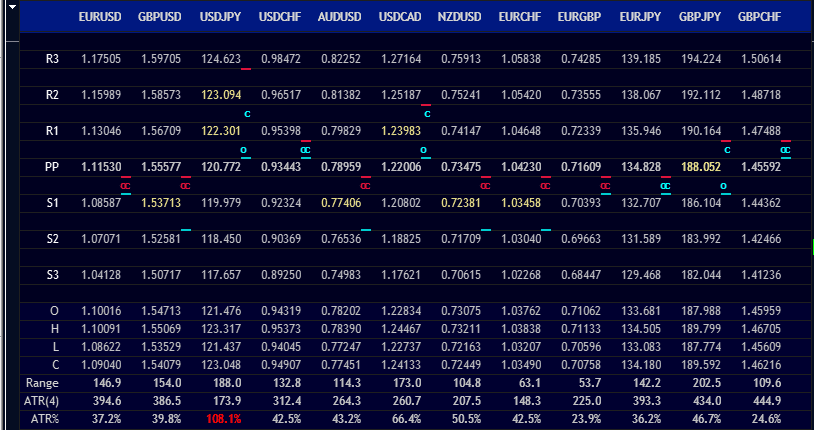

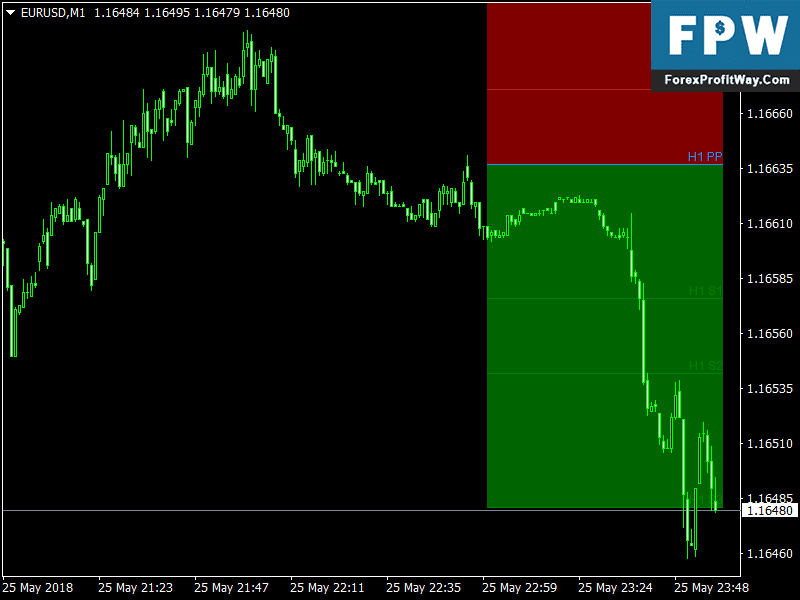

The pivot point calculation methods have evolved many times with traders adding various calculation methods and formulae to derive the pivots. Additionally, the additional support and resistance levels are the best candidates for further take profit and stop loss levels. While the best exit is the first available support or resistance based on the trend direction. Generally, a pivot point is the best entry point. Thus, forex technical traders establish the market trend using the pivot point. Similarly, traders anticipate a bearish market if the price moves lower than the pivot point. The market is expected to be in a bullish price trend if it moves higher than the pivot point. Based on the previous day’s values traders can anticipate if the current day’s trend will be bullish or bearish. The open, high, low, and close prices of the previous day determine the current day’s pivot point. Pivot levels are calculated by using the 4 important price points of the previous day. Indeed, traders can calculate multiple levels of support and resistance. The identification of the pivot point leads us to the location of the support and resistance. Though the heart of this MT4 indicator is to identify the pivot point that identifies the bullish or bearish market trend.

What is the current market trend? Where are the support and resistance located?

They answer the two most important questions for technical forex traders. Most importantly, is based on mathematical calculation and allows no room for error due to the manual calculation of the trader. Pivot points are an excellent leading indicator in technical analysis.

0 kommentar(er)

0 kommentar(er)